Hyderabad, Jan 28 : The Confederation of Real Estate Developers’ Associations of India (CREDAI), the apex body for private real estate developers in India, expressed its concern over the RBI decision to increase the Repo Rates by 25 bps to 8% in the monetary policy review. The step was unexpected as the industry was expecting RBI to give precedence to growth over inflation especially as prices are trending downwards, core inflation is within the comfort zone.

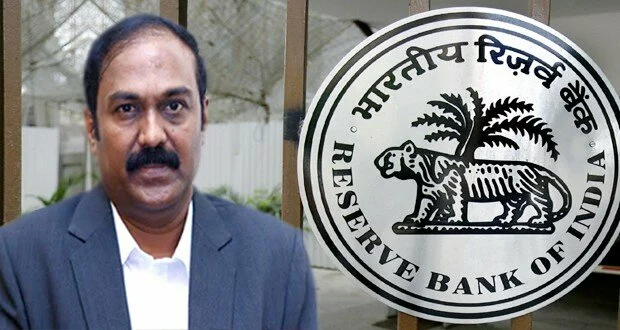

Speaking on the development, CREDAI National President C Shekar Reddy said, “The RBI’s decision to increase the repo rate by 25 bps is shocking as it was not expected and took the industry by surprise. The industry expected the RBI to maintain the status quo on rates as the index for industrial production was at the low of -2.1% for December. With inflation at a three-month low to 9.87% from record high of 11.16% and WPI inflation on a five month low at 6.16% from 7.52% in the previous month, this was the opportune time to take measures to propel industrial growth.”

Reddy urged the RBI to take proactive measure to reduce the lending rates and increase the share of funding to the real estate sector which is currently at a low of 2.7% to the Developers and 9% to the home buyers. This 12% funding to the sector is quite meagre and should be raised to 15% to the Developers for project funding and an overall of 24% which will be comparable to 32% in USA and 22% in China. The housing sector is poised to grow manifold in the next decade and a half and will require a capital investment of about $1.2 Trillion. RBI should liberalize the norms and also lower the interest rates so that this sector with the high multiplier effect can propel the economy to the double digit GDP growth and accelerated capital formation not only in this sector but also in all the 300 allied industries, he said. INN

INN Live Urdu News Channel – India Breaking News, Headlines, Hyderabad اردو خبریں

INN Live Urdu News Channel – India Breaking News, Headlines, Hyderabad اردو خبریں